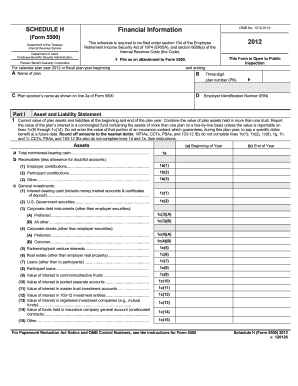

DoL 5500 - Schedule H 2018-2026 free printable template

Instructions and Help about DoL 5500 - Schedule H

How to edit DoL 5500 - Schedule H

How to fill out DoL 5500 - Schedule H

Latest updates to DoL 5500 - Schedule H

All You Need to Know About DoL 5500 - Schedule H

What is DoL 5500 - Schedule H?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

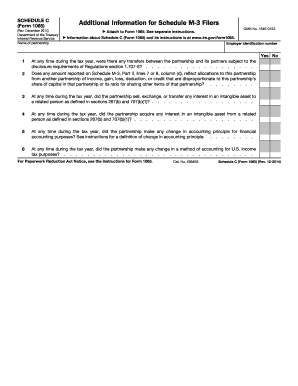

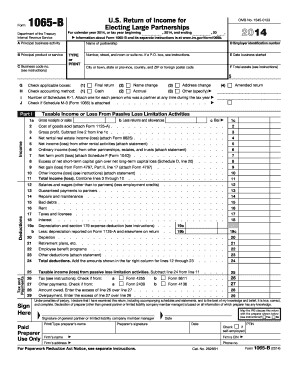

Is the form accompanied by other forms?

FAQ about DoL 5500 - Schedule H

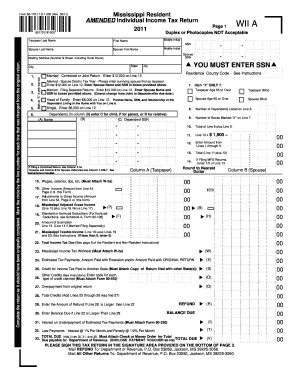

What should you do if you realize there is an error after submitting your DoL 5500 - Schedule H?

If you discover an error in your DoL 5500 - Schedule H after submission, you can file an amended return to correct it. Ensure you clearly indicate that it is an amended form and provide the correct information. Additionally, keep documentation supporting the changes made for your records.

How can you track the status of your filed DoL 5500 - Schedule H?

To track the status of your filed DoL 5500 - Schedule H, you can use the online tracking system provided by the IRS or Department of Labor. This system allows you to verify if your form has been received and processed. Be prepared to enter relevant identification details for accurate tracking.

Are e-signatures acceptable when filing the DoL 5500 - Schedule H electronically?

Yes, e-signatures are generally acceptable for filing the DoL 5500 - Schedule H electronically, provided they comply with the e-signature regulations. Ensure that your e-signature method meets the requirements set by the IRS, as this will help validate the authenticity of your submission.

What should you include in your documentation if you receive a notice regarding your DoL 5500 - Schedule H?

If you receive a notice concerning your DoL 5500 - Schedule H, gather all relevant documentation, including copies of the submitted forms, any correspondence from the agency, and supporting records related to the issues mentioned in the notice. Respond promptly and include a clear explanation addressing the concerns raised.

What common errors should you avoid when filing the DoL 5500 - Schedule H?

To avoid common errors when filing the DoL 5500 - Schedule H, double-check all entries for accuracy and completeness, ensuring you provide all required information. Additionally, verify that you are filing the correct version of the form as per your plan year and any applicable updates from the IRS.

See what our users say